Investing your money is a great way to increase your wealth. Unfortunately, many investors spend most of their efforts researching the best investment options for their needs without considering taxes. The federal government collects taxes on both investment income and realized capital gains. Investments can make tax time complicated, and not all investors understand the tax implications of their investment portfolios. Take a look at what you can expect during tax season to avoid any surprises.

Capital Gains Taxes

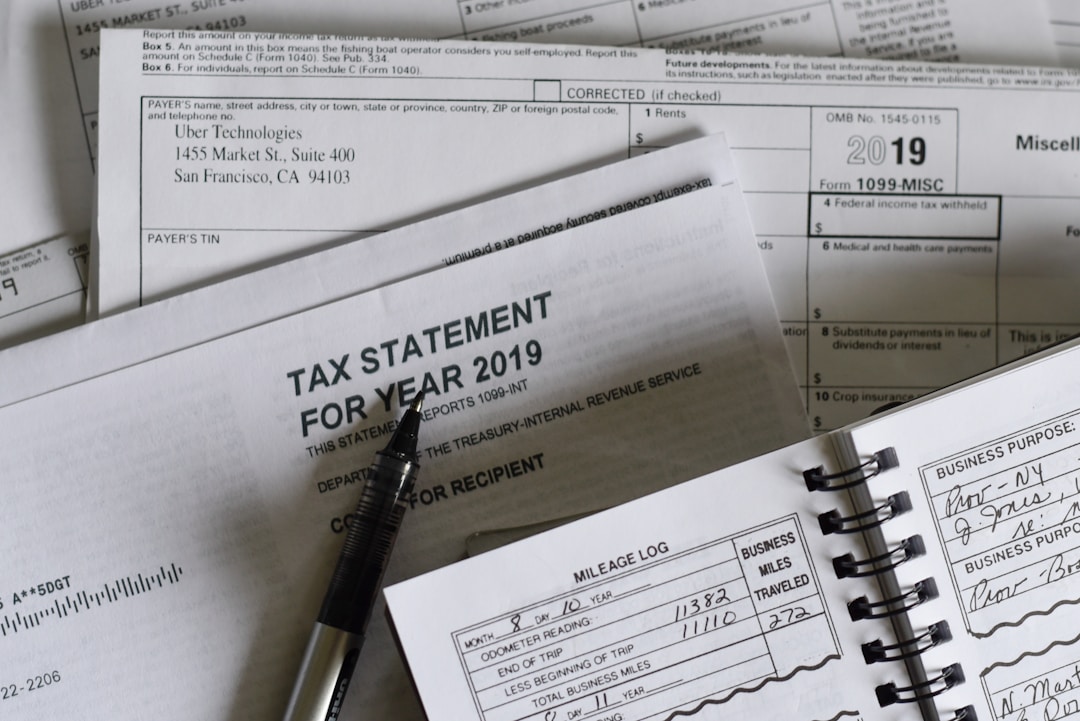

When you sell an asset such as a stock share, a piece of land, or a business, you earn taxable income. You may have to pay taxes on the gains earned from the sale of an asset. The amount of time you held the asset before selling it determines the tax rate you pay.

Investing in the stock market can be lucrative for savvy traders. One type of risky investment that can have a potentially attractive ROI is penny stocks. They have a low share price of less than $5, unlike regular stocks with a high share price of $5 or more. Small companies with shares trade of $5 or less don’t have much trade volume. Canadian penny stocks trade on the Toronto Stock Exchange (TSX), TSX Venture Exchange, Canadian Securities Exchange, and NEO Exchange. U.S. penny stocks trade on the New York Stock Exchange (NYSE), Nasdaq, the Over-the-Counter Bulletin Board (OTCBB), and Pink Sheets.

The personal finance website Wealth Rocket offers its picks of the best cheap stocks Canada has to offer. Their picks of the best penny stock trading platforms include 5N Plus, American Lithium Corp, CloudMD Software & Services, Drone Delivery Canada, Exro Technologies, and Good Natured Products.

Dividends Taxes

You should expect to pay taxes on any dividends the same year they’re received. There are two types of taxable dividends. Nonqualified dividends fall under the regular income tax bracket. Qualified dividends usually have a lower tax rate of 0 to 20 percent depending on your taxable income and filing status.

401(k) Taxes

The good news about investing in your 401(k) retirement account is that you don’t pay taxes on investment gains, interest, or dividends. However, once you make a withdrawal from your 401(k) account, you’ll have to pay income taxes in the year you make the withdrawal. In addition, there are additional penalties for withdrawing before the age of 59.5 or withdrawing after the age of 72.

Expert tax preparers know the best way to get through tax season is to stay organized. A great way to give a professional presentation of clients’ tax returns is to place them in tax return folders. The Mines Press carries a vast collection of tax return folders that will dress up the final results of your work. Accountants can explore an array of foil-stamped and printed tax return folders and non-personalized folders with space for business cards. You can even find tax folders compatible with tax software programs and supplies to keep you prepared and organized, including file folders, toners, staples, and binders.

Mutual Funds Taxes

You’ll have to pay mutual fund taxes if your mutual fund generates and distributes dividends, interest, or capital gains. The tax rate is determined by the type of distribution you receive. You may owe taxes on mutual funds regardless of selling or receiving cash.

Property Sale Taxes

You may be obligated to pay taxes on what you gain from the sale of your home. The IRS allows single tax filers to exclude up to $250,000 of gains and married filing jointly filers to exclude up to $500,000. The tax rate you pay on the sale of a home depends on your income level and tax-filing status.

It’s a good idea to have a professional tax preparer or accountant prepare your tax return for the coming tax season. Tax professionals know how to navigate tax laws and codes and help you maximize your return.